Dollar Cost Averaging

What is dollar cost averaging?

Its a investment strategy used to invest fixed amount on regular basis.

More shares are bought when the price is low and less shares are bought when

the price is high. As same amount buys more shares when price is low, this

strategy could be effective in reducing average cost per share.

More shares are bought when the price is low and less shares are bought when

the price is high. As same amount buys more shares when price is low, this

strategy could be effective in reducing average cost per share.

Calculator for dollar cost averaging:

Dollar cost averaging formula

Gain/loss per wiki page is defined as:

(Final_price / Harmonic_mean - 1) * 100%

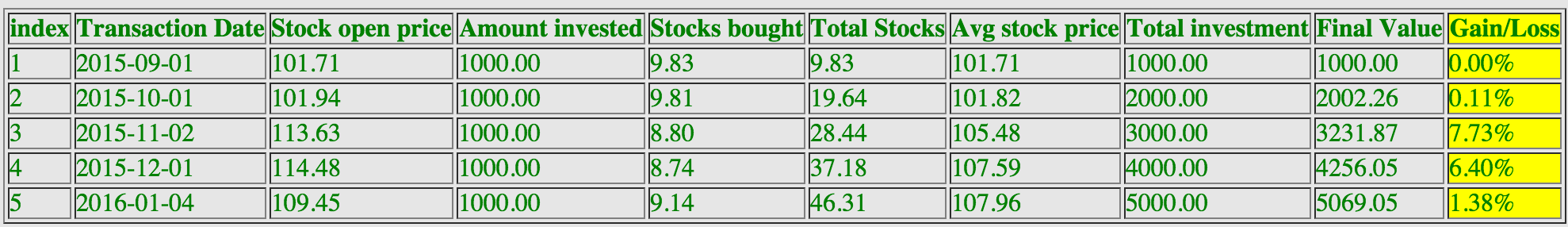

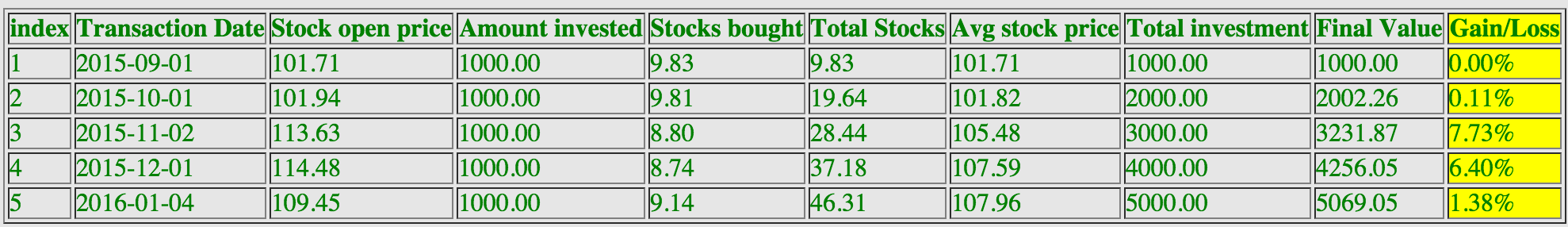

For example, For qqq from Sept2015 to Jan2016

Harmonic_mean = 5/(1/101.94 + 1/113.63 + 1/114.48 + 1/109.45 + 1/101.71) = 107.96

Final_price = 109.45

gain/loss% = (109.45/107.96 - 1) * 100% = 1.38%

(Final_price / Harmonic_mean - 1) * 100%

For example, For qqq from Sept2015 to Jan2016

Harmonic_mean = 5/(1/101.94 + 1/113.63 + 1/114.48 + 1/109.45 + 1/101.71) = 107.96

Final_price = 109.45

gain/loss% = (109.45/107.96 - 1) * 100% = 1.38%

My take on dollar cost averaging.

Market is turbulent, it's very difficult if not impossible to detect market bottom.

Thus better use dollar cost averaging instead of lump-sump investment.

Moreover as a person is investing significant money using this method,

choose some index fund instead of a single stock.

Thus better use dollar cost averaging instead of lump-sump investment.

Moreover as a person is investing significant money using this method,

choose some index fund instead of a single stock.

Dollar Value Averaging

What is dollar value averaging?

It's an investment strategy in which portfolio balance is set to increase by fixed amount.

Note that in the case of DCA, investor invests fixed amount, here investment amount is not

fixed but the investment balance is fixed. It might require investor to actually withdraw

if the investment goes up significantly.

Note that in the case of DCA, investor invests fixed amount, here investment amount is not

fixed but the investment balance is fixed. It might require investor to actually withdraw

if the investment goes up significantly.

Calculator for dollar value averaging: